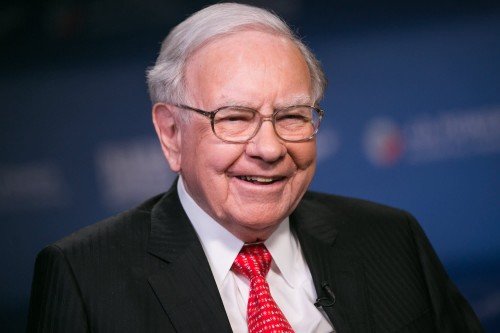

Warren Buffett is one of the most successful investors of all time. Born in 1930 in Omaha, Nebraska, he has built an incredible fortune through his investment firm, Berkshire Hathaway, which he has led since 1965. Despite his immense wealth, Buffett is known for his frugal lifestyle and commitment to philanthropy.

One of the keys to Buffett's success is his adherence to a value investing strategy. This means he looks for companies that are undervalued by the market and have strong fundamentals, such as a solid balance sheet and consistent earnings growth. He then invests in these companies for the long term, sometimes holding onto stocks for decades.

There are several key factors that have contributed to Warren Buffett's success:

-

Value investing: Buffett's investment philosophy is based on identifying undervalued companies with strong fundamentals, and investing in them for the long term. By buying stocks at a discount to their intrinsic value, he has been able to generate significant returns over time.

-

Patience and discipline: Buffett is known for his ability to stay disciplined and patient in his investment approach, even during turbulent markets. He doesn't try to time the market or chase short-term gains, instead focusing on long-term value creation.

-

Focus on quality: Buffett has a strong preference for high-quality companies with strong competitive advantages, or "moats." By investing in companies with durable competitive advantages, he is able to generate steady returns over time.

-

Risk management: Buffett is very focused on managing risk in his investments. He avoids companies with high levels of debt, and is very cautious about investing in businesses he doesn't understand.

-

Continuous learning: Despite his immense success, Buffett is always learning and seeking new knowledge. He spends much of his time reading and studying, and is constantly looking for ways to improve his investment approach.

-

Long-term perspective: Finally, Buffett has a very long-term perspective on investing. He doesn't get caught up in short-term market fluctuations or noise, and instead focuses on the long-term prospects of the companies he invests in. This allows him to ride out short-term volatility and generate strong returns over the long term.

Buffett is also known for his emphasis on buying high-quality companies with strong competitive advantages, or "moats." These moats can come in the form of brand recognition, patents, or economies of scale, among other things. By investing in companies with durable competitive advantages, Buffett is able to generate steady returns over time.

Despite his immense wealth, Buffett has remained committed to philanthropy throughout his life. In 2010, he and Bill Gates founded The Giving Pledge, a commitment by the world's wealthiest individuals to give away the majority of their wealth to charitable causes. Buffett has also donated billions of dollars to causes such as education and poverty alleviation.

One of the most interesting things about Buffett is his unique personality and approach to life. Despite being one of the wealthiest people in the world, he lives in a modest home in Omaha and drives a Cadillac. He is known for his love of Cherry Coke and his folksy sense of humor. He also has a deep love of learning and spends much of his time reading and studying.

Here are some interesting things about Warren Buffett:

-

He bought his first stock when he was just 11 years old.

-

Despite his immense wealth, he still lives in the same modest home in Omaha that he bought in 1958 for $31,500.

-

He has pledged to give away more than 99% of his wealth to philanthropic causes.

-

He is a voracious reader, and spends up to six hours a day reading books and newspapers.

-

He is known for his folksy sense of humor and down-to-earth personality.

-

He has been a vocal critic of excessive CEO pay and has called for greater accountability and transparency in corporate governance.

-

He is a big fan of Cherry Coke, and drinks several cans a day.

-

He has a close friendship with Bill Gates, and the two have collaborated on philanthropic projects such as The Giving Pledge.

-

He has been a major supporter of political causes, particularly those related to financial regulation and tax policy.

-

He is an advocate for simple, easy-to-understand investment strategies, and is known for his aversion to complex financial instruments.

-

There are many books about Warren Buffett, but the best book is Snowball by Alice Schroeder.

Overall, Warren Buffett is an inspiring figure who has achieved incredible success through his investment acumen, commitment to value investing, and dedication to philanthropy. His life and career offer valuable lessons for anyone looking to build wealth and make a positive impact on the world.